Planning to take a loan but unsure about monthly payments? An EMI calculator is your financial companion that helps you make informed borrowing decisions. This comprehensive guide will walk you through everything you need to know about EMI calculators and how they can simplify your loan journey.

View Amortization Schedule

| Month | EMI | Interest | Principal | Balance |

|---|

What is an EMI Calculator?

An EMI (Equated Monthly Installment) calculator is a digital financial tool that helps borrowers determine their monthly loan repayment amount. It performs complex mathematical calculations instantly, showing you exactly how much you need to pay each month based on your loan amount, interest rate, and repayment tenure.

Think of it as your personal financial advisor that works 24/7, providing accurate loan estimates within seconds. Whether you’re planning a home purchase, buying a car, or considering a personal loan, this tool eliminates guesswork from your financial planning.

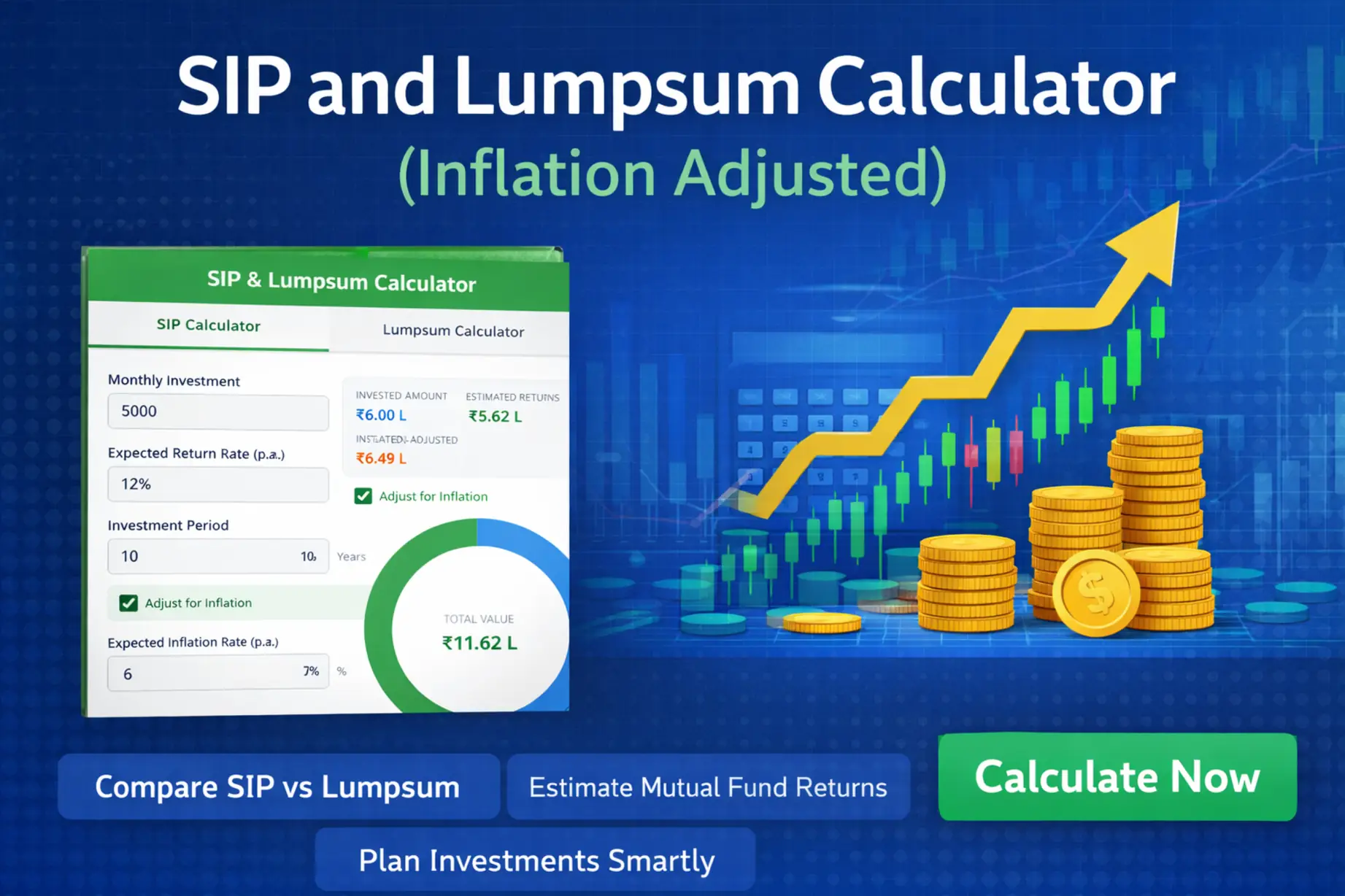

You can also check the related calculator from here: SIP Calculator, Lumpsum Calculator, and Many more.

How Does an EMI Calculator Work?

The calculator uses a standard mathematical formula to compute your monthly installment:

EMI = (P *R *(1+R)^N)/((1+R)^N-1)

Where:

- P = Principal loan amount

- R = Interest rate (Monthly)

- N = Loan tenure in months

Simply input your loan details, and it instantly displays your EMI along with a detailed breakdown of principal and interest components.

Who Can Use an EMI Calculator?

Home Loan Seekers

Anyone planning to purchase a house or apartment can use this tool to estimate home loan EMIs. With property prices soaring, understanding your monthly commitment before applying helps avoid financial strain.

Car Buyers

Whether buying a new or used vehicle, car loan EMIs significantly impact your monthly budget. Calculate beforehand to ensure comfortable repayment without compromising other financial goals.

Personal Loan Applicants

Personal loans serve various purposes—weddings, medical emergencies, vacations, or debt consolidation. An EMI calculator helps determine affordable loan amounts based on your repayment capacity.

Education Loan Borrowers

Students and parents planning higher education can estimate EMI obligations before committing to education loans. This foresight helps plan careers and repayment strategies more effectively.

Business Owners

Entrepreneurs seeking business loans can evaluate different funding scenarios to choose options that don’t strain their business cash flow.

How to Use Our EMI Calculator: Step-by-Step Guide

Step 1: Select Your Loan Type

Choose from multiple loan categories:

- Home Loan

- Car Loan

- Personal Loan

- Education Loan

- Business Loan

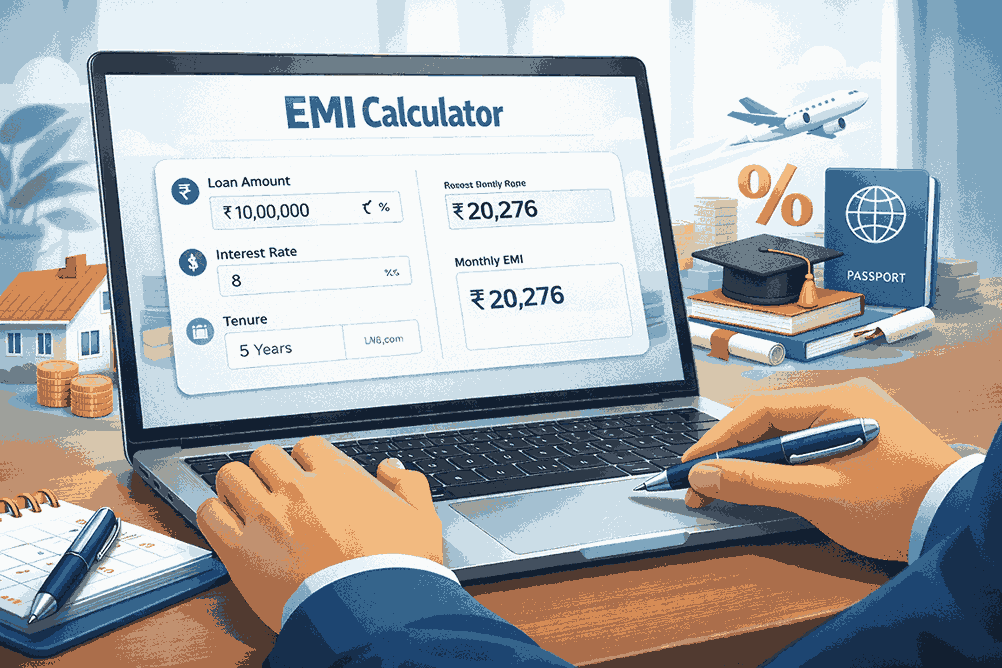

Step 2: Enter the Loan Amount

Input the total amount you wish to borrow. You can either type the figure directly or use the convenient slider to adjust the amount.

Pro Tip: If buying property or a vehicle, subtract your down payment from the total cost to determine your actual loan requirement.

Step 3: Set the Interest Rate

Enter the interest rate offered by your targeted bank. Interest rates vary significantly based on loan type, lender policies, and your credit score.

Remember: Even a small difference in interest rates can significantly impact your total repayment amount, especially for long-tenure loans.

Step 4: Choose Your Loan Tenure

Select the repayment period in years. The higher the repayment time reduce monthly EMI but it can increase interest payment. Smaller repayment time can result in higher EMIs but potential savings in interest.

Step 5: Calculate and Review Results

Click the “Calculate EMI” button to get your results. The calculator displays:

- Monthly EMI: Your exact monthly payment amount

- Principal Amount: The original loan amount

- Total Interest: Complete interest payable over the loan tenure

- Total Amount Payable: Sum of principal and interest

Step 6: Analyze the Visual Breakdown

The interactive doughnut chart provides a visual representation of your payment structure. The colorful segments clearly distinguish between principal repayment and interest payment, helping you understand the loan’s cost at a glance.

Step 7: Adjust and Compare

You can go though trial and error method to get your desired result for different combinations of loan amount, interest rate, and tenure. You might discover that:

- Increasing tenure by a few years significantly reduces EMI

- A slightly higher down payment dramatically cuts interest costs

- Shorter tenure saves lakhs in interest despite higher monthly payments

Smart Tips for Using EMI Calculators Effectively

Calculate Before You Apply

Always use an EMI calculator before visiting lenders. This preparation helps you negotiate confidently and avoid unsuitable loan offers.

Factor in Your Income

Financial experts recommend keeping your EMI below 40-50% of your monthly income. This can create headroom for other expenses, savings, and emergency needs.

Consider Hidden Costs

Remember that loans come with additional expenses—processing fees, insurance premiums, and prepayment charges. Factor these into your overall affordability assessment.

Plan for Rate Fluctuations

If considering a floating rate loan, calculate EMIs at slightly higher interest rates to prepare for potential rate increases.

Evaluate Prepayment Options

Use the calculator to see how prepaying a portion of your loan reduces both tenure and interest burden. This insight helps plan strategic prepayments when you have surplus funds.

Making Your Final Decision

An EMI calculator is your starting point, not your final decision. After calculating:

- Assess Your Comfort Level: Can you sustain this EMI for the entire tenure?

- Check Your Credit Score: Better scores unlock lower interest rates

- Compare Multiple Banks: Compare the Different Lenders for their offers.

- Read Terms Carefully: Understand all conditions, penalties, and charges

- Consult Financial Advisors: For large loans, professional guidance adds value

Conclusion

An EMI calculator transforms loan planning from overwhelming to empowering. By providing instant, accurate calculations and visual insights, it helps you make confident financial decisions aligned with your goals and capabilities.

Start using our EMI calculator today and take the first step toward informed, stress-free borrowing. Your financial wellbeing deserves nothing less than complete clarity and confidence.