Trading Risk Management Calculator

Professional Position Sizing & Risk Control System

Risk Parameters

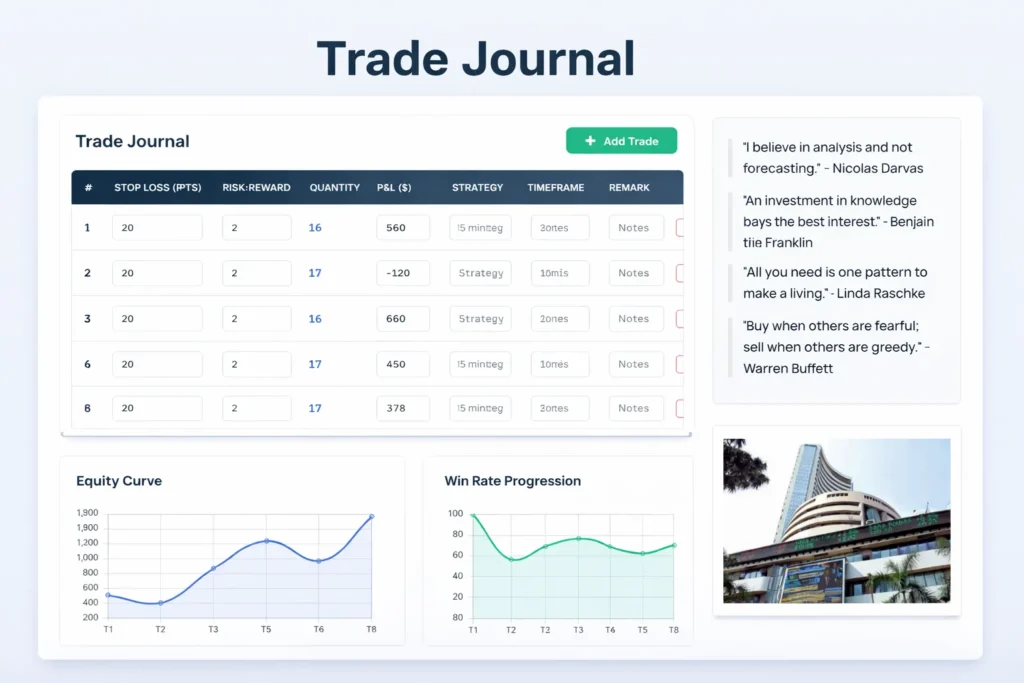

Trade Journal

| # | Stop Loss (pts) | Risk:Reward | Quantity | P&L (₹) | Strategy | Timeframe | Remark | Action |

|---|

Equity Curve

Win Rate Progression

How to Use Trading Risk Management Calculator (Step-by-Step Guide) – (Here )

Position Sizing & Capital Protection Tool for Traders

The Trading Risk Management Calculator is a professional tool built to help traders manage capital, control losses, and trade with discipline. It simplifies risk management trading by calculating accurate position sizing, defining proper stop loss, and maintaining a healthy risk reward ratio in trading.

Whether you are into stock market trading, day trading, forex trading, or crypto trading, this calculator ensures that every trade follows a structured risk management system—not emotions.

Why Use a Trading Risk Management Calculator?

- Controls Risk Per Trade

Automatically defines how much to risk on each trade using proper risk management rules. - Accurate Position Sizing

Calculates exact quantity based on stop loss, ensuring correct position sizing and risk management. - Capital Protection

Prevents overtrading and protects capital through a structured Risk Management Plan. - Maintains Discipline

Lock feature enforces strict trading risk management, avoiding emotional decisions. - Improves Consistency

Helps traders follow professional trade management strategies for long-term survival.

Who Should Use This Calculator?

- Beginners learning risk management for beginners

- Day traders managing multiple trades

- Forex & crypto traders handling leverage

- Stock market traders improving consistency

- Traders focused on money management and risk management in trading

How the Calculator Works

- Define your risk management strategy

- Lock parameters to avoid emotional changes

- Execute trades with proper position sizing, stop loss, and risk reward ratio

How to Use Trading Risk Management Calculator (Step-by-Step Guide) – (Here)

Trade Smart, Not Emotional

Trading without risk management is gambling.

This Trading Risk Management Calculator helps you trade professionally by enforcing discipline, protecting capital, and improving long-term performance.

Start Trading With Proper Risk Management

Trading without risk management is gambling.

Trade smarter, protect your capital, and build long-term consistency.