When you begin trading in the stock market, one of the essential skills you’ll need is knowing how to place an order through your broker’s trading terminal. Order facility availability vary broker to broker, so this is very crucial to choose right brokers as per your requirements. The process may seem daunting at first, but once you understand the various types of orders and other parameters, it becomes much more straightforward for you. Here’s a detailed guide to help you navigate the order window and place the right order based on your trading strategy.

A) Types of orders to Place Orders

Market Order

A market order is an instruction to buy or sell a security immediately at the current market price. Since there’s no price specification, the order will execute at the best available price.

Example: Suppose you want to buy 100 shares of XYZ Ltd., and the current market price is ?150. You place a market order, and the shares are bought at the prevailing price, which might be ?150 or slightly higher or lower depending on market fluctuations.

Limit Order

A limit order allows you to buy or sell a security at a specific price or better. The order will only execute at the limit price or a more favorable one.

Example: If you want to buy shares of XYZ Ltd. but only if the price drops to ?145, you place a limit order with ?145 as the limit price. The order will only execute if the market price reaches ?145 or less.

Stop Loss Order

A stop loss order is designed to limit the losses of an investor’s if price moves against the position taken by investors by placing stop loss order at a market price or limit price order. When the stock reaches a specified price then positions will be automatically square-off.

Types of stop loss order

Stop Loss Market Price: Positions will be square-off at market price when the trigger price is reached.

Stop Loss Limit Price: Positions will be square-off at limit price given at the time of placing orders, when the trigger price is reached.

Trigger Price

This is the price at which the stop loss order becomes active. The trigger price is necessary to ensure that your order is executed automatically only when the market reaches a specific price level. It helps you manage risk by setting a point at which your order becomes active, protecting you from further losses or ensuring your trade is executed at the right moment without order failure.

Example: If you bought shares of XYZ Ltd. at ?150 and want to limit your loss, you can set a stop loss market order with a trigger price of ?140. If the price drops to ?140, your shares will automatically be sold at the best available market price.

Cover Order

A cover order combines a market order or limit order with a compulsory stop loss, it means you have to place two order at one time to ensuring risk management by limiting potential losses.

Example: Suppose you place a cover order to buy shares of XYZ Ltd. with a market order and a stop loss of ?140. This means you buy the shares at the current price but also have a stop loss in place to protect against a significant drop.

Bracket Order

A bracket order includes three orders at a time, means you have to place a buy or sell order, a target price order, and a stop loss order at the same time. Once the initial order is executed, the target and stop loss orders become activated.

Example: You buy shares of XYZ Ltd. at ?150 and set a target price of ?160 and a stop loss at ?145. If the price reaches ?160, your position is sold at a profit; if it drops to ?145, the stop loss triggers to limit your loss.

Basket Order

A basket order allows you to place multiple orders for different securities at the same time means you can buy shares of multiple companies at the same time at one click.

Example: You can create a basket with orders to buy 50 shares of XYZ Ltd., 100 shares of ABC Ltd., and 75 shares of DEF Ltd., and place them simultaneously.

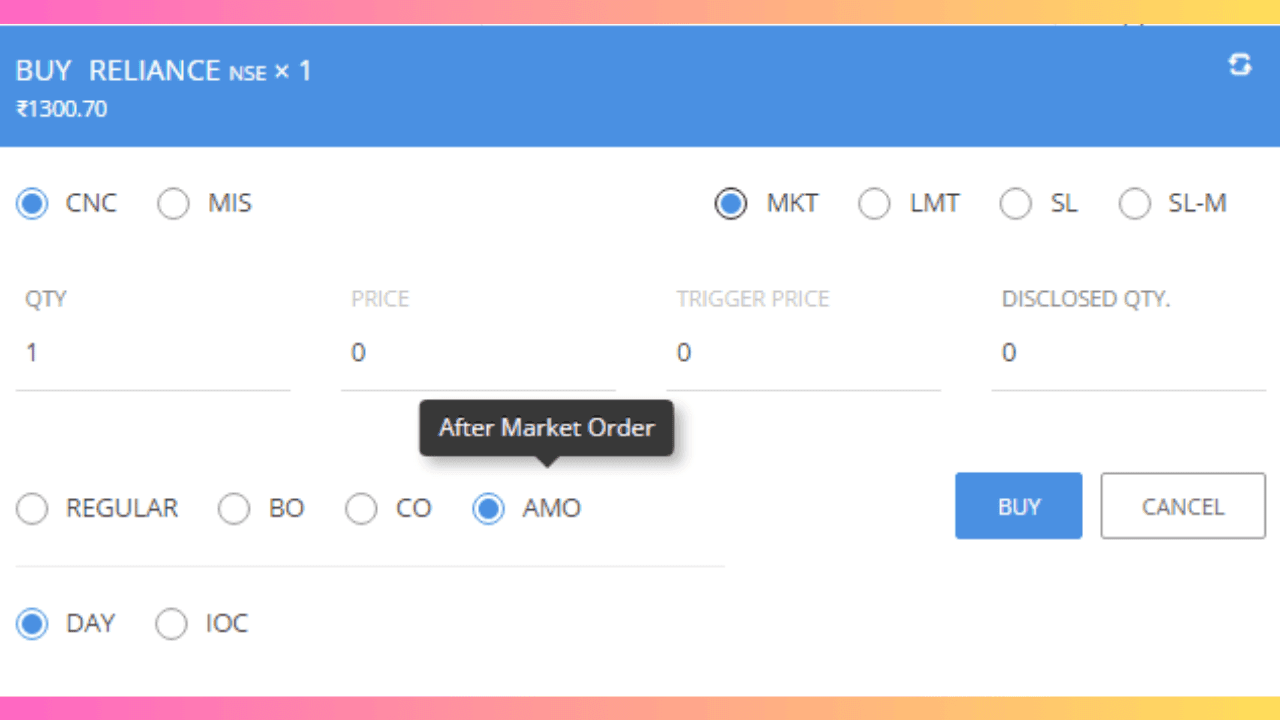

After Market Order (AMO)

An After Market Order (AMO) is an order to buy or sell shares that is placed after the regular trading hours of the stock market. Since the stock market operates only during specific hours, AMOs allow investors to plan their trades outside of these hours. The order gets queued and is executed when the market opens on the next trading day.

Example: You place order in regular trading hours of the stock market from 9:15 AM to 3:30 PM. You notice that the price of a particular stock might rise based on news released after the market has closed. However, you won’t be available to place an order the next morning.

You place an AMO to buy 100 shares of Company XYZ at 500 per share after 3:30 PM. The order is queued by your broker and will be executed when the market opens the next morning at 9:15 AM. If the stock opens at or below ?500 per share, your order may be executed at your specified price or lower. If the stock opens above ?500, your order might not be executed, or it could be partially filled, depending on the opening price and the availability of shares. AMOs are particularly useful for those who cannot trade during regular market hours or want to react to news and events that occur after the market closes.

B) Product Type

Cash/CNC (Cash and Carry)

When you place order by selecting CNC this will give you facility for delivery-based trading like swing trading, positional trading and long term investment where you pay the full amount for the shares and hold them in your demat account.

Example: If you buy 100 shares of XYZ Ltd. under CNC, the shares will be delivered to your demat account, and you can hold them as long as you like.

NRML (Normal)

NRML is used to place order for positional trading in the futures and options market, where you can hold your position until the contract expires and also useful where you are using margin available after pledging the shares available in your demat account.

Example: If you buy a futures contract on XYZ Ltd., you can hold the position until the contract’s expiry date under NRML.

MIS (Margin Intraday Square-off)

MIS is used to place order for intraday trading, where positions must be squared off before the market closes.

Example: You buy 100 shares of XYZ Ltd. using MIS with the intent to sell them within the same day. If you don’t square off the position, the broker will do it automatically before the market closes.

MTF (Margin Trading Funding) / Pay Later

MTF stands for margin trading funding which used to place order to buy shares by paying a fraction of the total value as you want to buy and borrowing the remaining amount from your broker.

Example: You want to buy shares worth ?1,00,000 but only have ?30,000. Using MTF, you can pay ?30,000 and borrow the remaining ?70,000 from the broker.

C) Validity

Day

A day order remains active until the end of the trading day. If the day order not executed until the market close, it’s automatically canceled. This is facilitate to place order for one day validity.

Example: You place a limit order to buy shares of XYZ Ltd. at ?145 with day validity. If the price doesn’t reach ?145 by the market close, the order will be canceled.

IOC (Immediate or Cancel)

When you place order by using IOC, this order attempts to execute all or part of the order immediately. If Any case part of you ordered quantity is not filled immediately will be canceled at the same time.

Example: You place an IOC order to buy 100 shares of XYZ Ltd. If only 60 shares are available at your desired price, the order will buy those 60 shares and cancel the remaining 40 shares.

GTT Order (Good Till Triggered)

A GTT order remains active until the specified conditions are met. Unlike a day order, which expires at the end of the trading session, a GTT place order can remain active for days, weeks, or even months. Many brokers allow GTT order for one year, means your order remains active up to one year.

Example: You place a GTT order to buy shares of XYZ Ltd. at 140. The order will stay active until the stock price reaches 140 or you cancel the order. One of the leading broker Zerodha provide this GTT order.

D) Quantity and Disclosed Quantity

Quantity

When you place order in terminal this is the number of shares you wish to buy or sell. At the quantity section you have to put the number of shares you want to buy.

Example: If you enter 100, you are placing an order to buy/sell 100 shares.

Disclosed Quantity

At the time of placing order this allows you to disclose only a part of the total quantity to the market. This facility is used in the illiquid counter where numbers of buyers and sellers are less or you want to execute huge quantity at the same time.

Example: You want to buy 1,000 shares but disclose only 200 shares. The market sees only 200 shares until they are filled, after which another 200 shares are disclosed, and so on.

E) Price

When you place limit order then this is the price at which you want to execute your limit or stop loss limit orders.

Example: If you want to buy shares of XYZ Ltd. at ?145, you enter ?145 in the price field.

F) Exchange (NSE/BSE)

At the time of placing order you asked for the stock exchange where the order will be executed. NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) are the two primary exchanges in India. By this section you can choose to at which exchange you want to buy or sell.

Example: If you choose NSE, your order for XYZ Ltd. will be placed on the National Stock Exchange.

G) Conclusion

Understanding the various options in the order placing window of your broker’s trading terminal is crucial for executing trades effectively. Whether you’re a beginner or an experienced trader, familiarizing yourself with these order placing terms and how they work will help you make informed decisions and optimize your trading strategy. This detailed guide should provide a solid foundation for placing orders in the stock market, ensuring you are well-prepared to navigate the order placing window.