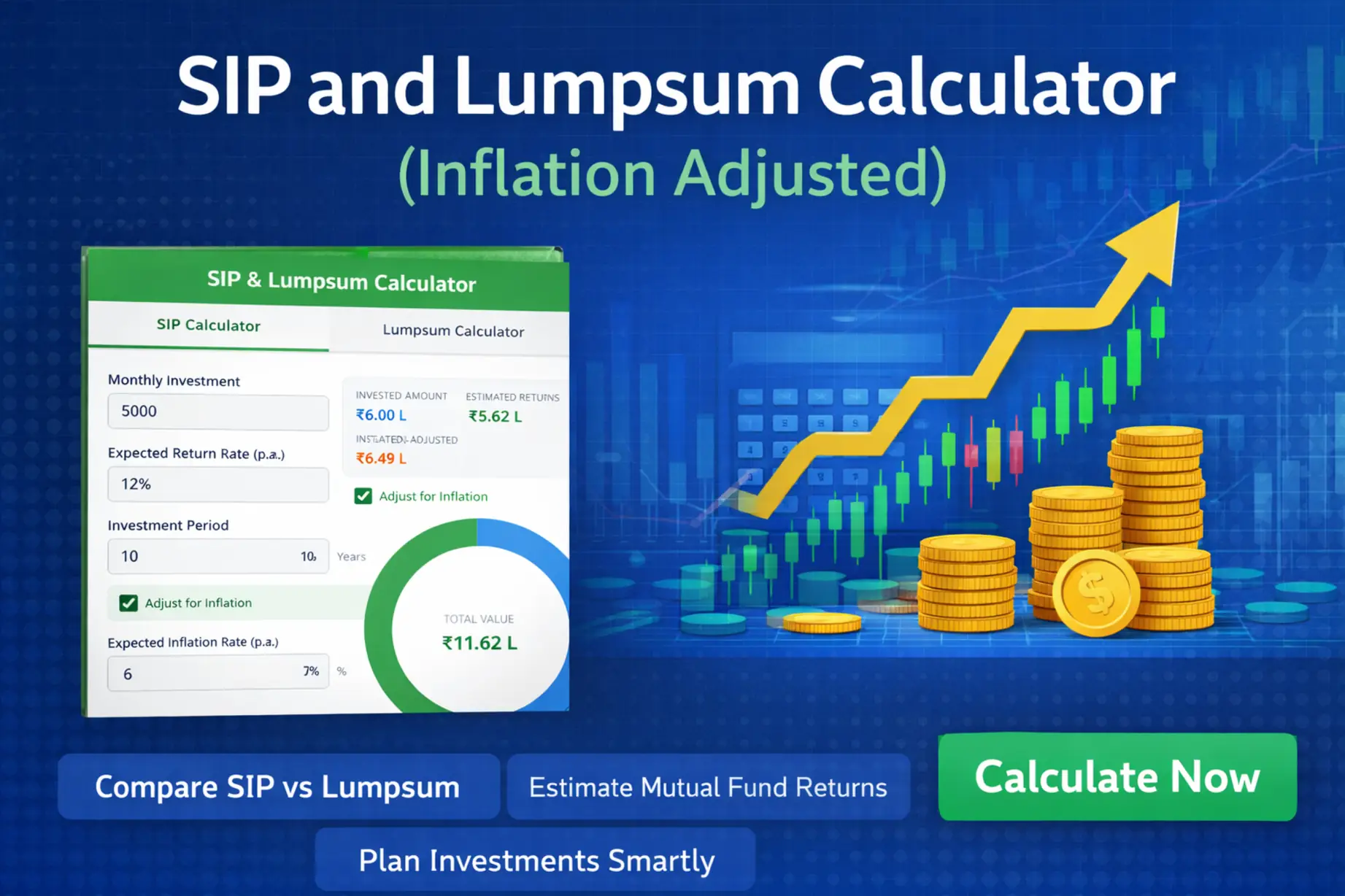

SIP & Lumpsum Investment Calculator

SIP and Lumpsum Calculator became essential for every investor in today’s time of mutual fund investing, whether you are a beginner or an experienced market participant. However, looking only at returns is not enough. Ignoring inflation is one of the biggest mistakes investors make.

To solve this problem, we have created the SIP and Lumpsum Calculator (Inflation Adjusted). This tool helps you understand:

- How much you actually invest

- Nominal returns vs real (inflation-adjusted) returns

- Whether SIP or Lumpsum is better for your financial goals

What is a SIP and Lumpsum Calculator?

A SIP (Systematic Investment Plan) and a Lumpsum Investment are two popular ways to invest in mutual funds.

This calculator allows you to compare:

- Monthly SIP investment

- One-time Lumpsum investment

- Expected annual rate of return

- Investment duration

- Inflation-adjusted real value of your investment

The main objective is to show your real purchasing power, not just paper returns.

Why is an Inflation-Adjusted Calculator Important?

The value of money decreases over time due to inflation.

For example:

- Nominal Return: 12% per annum

- Inflation Rate: 6% per annum

- Real Return ≈ 6% per annum

This calculator clearly shows:

- Returns without considering inflation

- Actual returns after adjusting for inflation

This helps you plan your long-term financial goals more realistically.

How to Use the SIP and Lumpsum Calculator (Step-by-Step)

SIP Calculator

- Enter your monthly investment amount

- Add the expected annual return rate (%)

- Select the investment period (in years)

- Enable the “Adjust for Inflation” option

- Enter the expected inflation rate (% per annum)

Lumpsum Calculator

- Enter the one-time investment amount

- Add the expected annual return rate

- Select the investment duration

- Enable inflation adjustment

The calculator will show:

- Total invested amount

- Estimated future value

- Inflation-adjusted real value

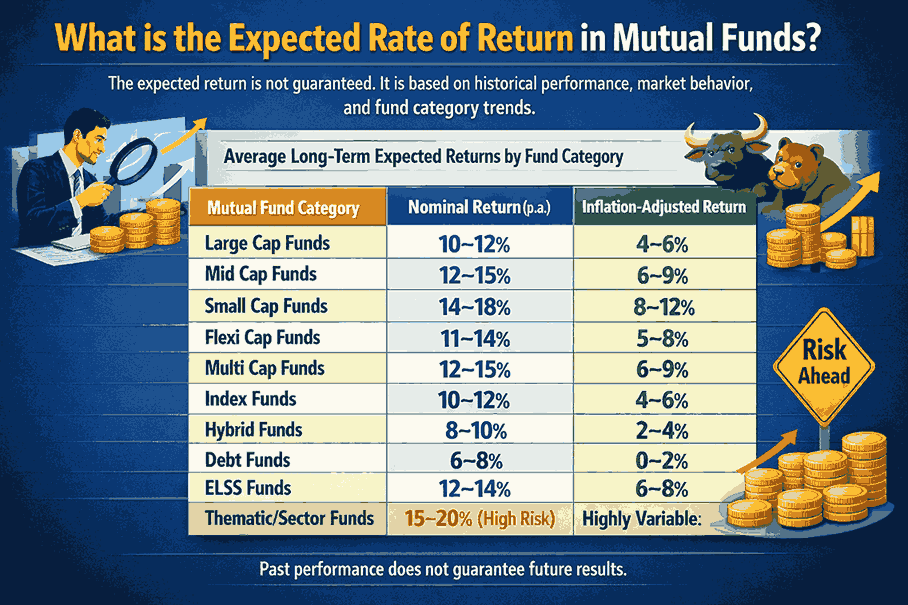

What is the Expected Rate of Return in Mutual Funds?

The expected return is not guaranteed. It is based on historical performance, market behavior, and fund category trends.

Average Long-Term Expected Returns by Fund Category

| Mutual Fund Category | Nominal Return (p.a.) | Inflation-Adjusted Return |

|---|---|---|

| Large Cap Funds | 10–12% | 4–6% |

| Mid Cap Funds | 12–15% | 6–9% |

| Small Cap Funds | 14–18% | 8–12% |

| Flexi Cap Funds | 11–14% | 5–8% |

| Multi Cap Funds | 12–15% | 6–9% |

| Index Funds | 10–12% | 4–6% |

| Hybrid Funds | 8–10% | 2–4% |

| Debt Funds | 6–8% | 0–2% |

| ELSS Funds | 12–14% | 6–8% |

| Thematic/Sector Funds | 15–20% (High Risk) | Highly Variable |

Past performance does not guarantee future returns.

SIP vs Lumpsum – Which is Better?

| Factor | SIP | Lumpsum |

|---|---|---|

| Market Timing | Not required | Important |

| Risk Level | Lower due to averaging | Higher |

| Suitable For | Salaried & beginners | Experienced investors |

| Volatility Impact | Lower | Higher |

For long-term wealth creation, SIP is generally considered more suitable.

Past Performance Insights (Category-Wise)

Equity Mutual Funds

- Equity funds have historically beaten inflation over the long term

- Small-cap and mid-cap funds delivered higher returns with higher volatility

Debt and Hybrid Funds

- More stable returns

- Usually struggle to beat the Indian Inflation Rate significantly

- Better suited for short-term or low-risk goals

Goal-Based Investment Expectations

| Financial Goal | Suitable Fund Type | Expected Real Return |

|---|---|---|

| Retirement Planning | Equity + Index Funds | 6–8% |

| Child Education | Equity + Flexi Cap | 6–9% |

| Emergency Fund | Liquid / Debt Funds | 0–2% |

| Tax Saving | ELSS Funds | 6–8% |

Benefits of Using Our SIP and Lumpsum Calculator

✔ Inflation-adjusted real returns

✔ Easy SIP vs Lumpsum comparison

✔ Beginner-friendly interface

✔ Free personal finance tool

✔ Helps in realistic financial planning

Final Thoughts

If you are only looking at nominal returns, you are seeing only half the picture.

The Inflation-Adjusted SIP and Lumpsum Calculator gives you a reality check and helps you make smarter, long-term investment decisions.

Use this calculator to plan your investments and align them with your real financial goals.

Disclaimer

This calculator is for educational and informational purposes only. Mutual fund investments are subject to market risks. Please consult a certified financial advisor before making any investment decisions.