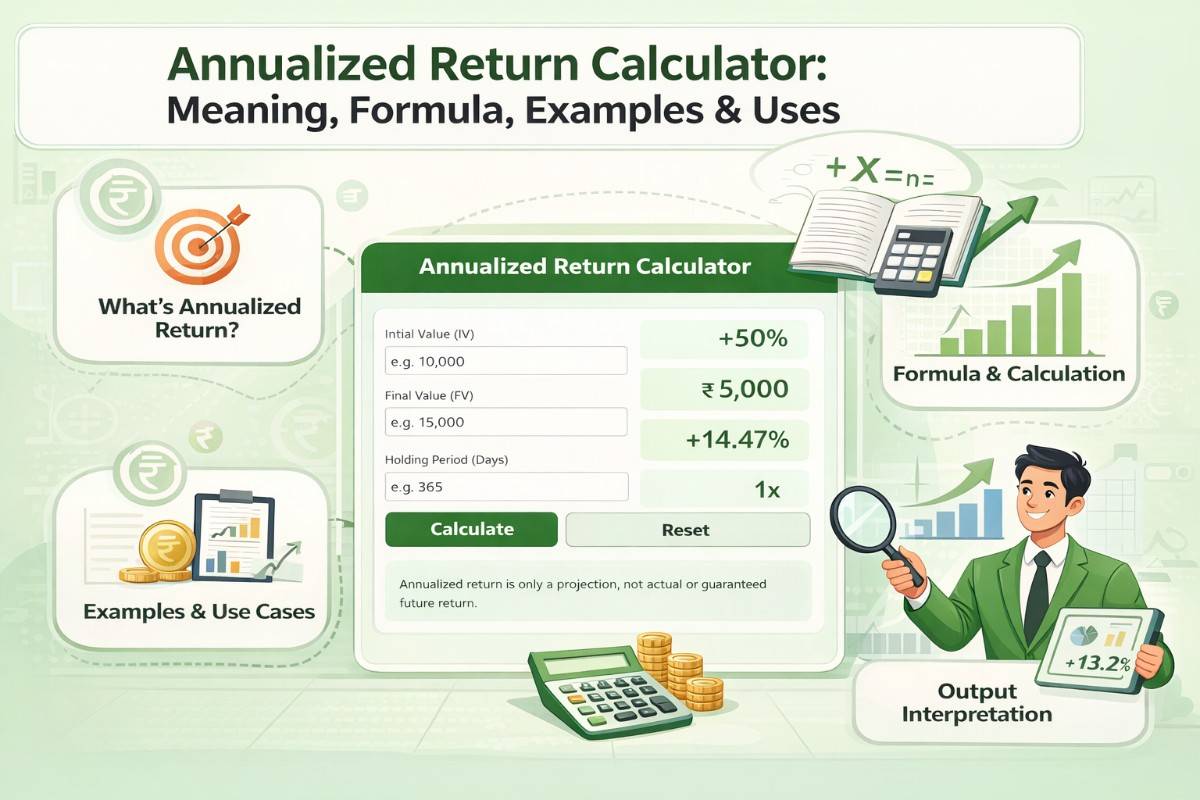

Annualized Return Calculator becomes extremely useful. When you eventually ask one simple question: how much did my money really grow? This is where understanding returns is the foundation of smart investing, and you need an Annualized Return Calculator, whether you invest in stocks, mutual funds, or any long-term asset.

This article explains annualized return in clear, practical terms, covers the formula, real-world examples, use cases, limitations, and helps you understand why annualized return is a normalized measure rather than an actual or guaranteed return.

What Is Annualized Return?

Annualized return is a standardized way of expressing investment performance on a per-year basis, regardless of how long the investment was held.

In simple words:

Annualized return shows the equivalent yearly growth rate that would mathematically lead to the same final value, assuming the same growth pattern repeats every year.

It does not describe what actually happened each year. Instead, it converts total past performance into an annual figure for comparison.

Meaning of “Return” in Finance

In finance, return means:

The rate at which capital grows or shrinks over a defined period of time.

Returns are generally divided into two categories:

- Actual Return – What has already happened (real profit or loss)

- Equivalent Return – A mathematical rate that produces the same final value

Annualized return belongs to the second category.

Why Do We Need Annualized Return?

Investments rarely have the same holding period. One investment may last 8 months, another 3 years, and another 10 years. Comparing their total returns directly would be misleading.

Annualized return solves this problem by:

- Normalizing returns to a yearly basis

- Making different investments comparable

- Reflecting the effect of compounding

- Following industry-standard performance reporting

This is why mutual funds, portfolio managers, and financial institutions report 3-year, 5-year, and 10-year annualized returns.

Annualized Return Formula

The standard formula used is:

Annualized Return = [(Final Value / Initial Value)^(1/n) − 1] × 100

Where:

- Initial Value (IV) = Starting investment amount

- Final Value (FV) = Ending investment value

- n = Number of years

This formula is also known as CAGR (Compound Annual Growth Rate).

Example of Annualized Return Calculation

Investment Details:

- Initial Investment: ₹1,00,000

- Final Value: ₹1,50,000

- Holding Period: 3 years

Calculation:

Annualized Return = [(1,50,000 / 1,00,000)^(1/3) − 1] × 100

= (1.5^0.333 − 1) × 100

= 14.47% per year

This means the investment grew as if it earned 14.47% every year, even though actual yearly returns may have varied.

What an Annualized Return Calculator Does

An Annualized Return Calculator automates this entire process and usually provides:

- Simple Return

- Absolute Gain

- Annualized Return

- Growth normalization insight (same growth rate repetition)

This helps investors avoid manual errors and understand performance more clearly.

Absolute Return vs Annualized Return

| Feature | Absolute Return | Annualized Return |

|---|---|---|

| Time factor | Ignored | Included |

| Compounding | Not considered | Considered |

| Best for | Short-term investments | Long-term investments |

| Comparison | Not suitable | Highly suitable |

Absolute Return simply shows how much you gained or lost.

Annualized Return shows how efficiently your capital grew when you repeat the same growth rate at the same holding period.

When Should You Use Annualized Return?

Ideal Use Cases

Annualized return works best when the investment period is more than one year:

- Mutual funds

- Long-term stock investments

- Retirement portfolios

- Real estate holdings

- Multi-year fixed deposits

In these cases, compounding plays a major role, and annualized return gives a realistic performance measure.

When Annualized Return Can Be Misleading

Less Than One Year

For investments held for less than one year, the annualized return can exaggerate performance.

Example:

- Investment period: 3 months

- Absolute return: 10%

Annualized return ≈ 46%

This does not mean you actually earned 46%. It only shows what the return would look like if the same short-term performance repeated for a full year.

For short-term investments, absolute return is more appropriate.

Annualized Return Is Not a Future Guarantee

A common misconception is that annualized return predicts future performance. This is incorrect.

Important points to remember:

- Annualized return is based on past data

- It assumes uniform growth, which markets rarely deliver

- It does not account for volatility

- It does not guarantee future results

Annualized return is a normalization tool, not a forecast.

Understanding the “Same Growth Rate Repeats” Concept

When an annualized return is shown, it silently assumes:

The same effective growth rate will repeats for the same holding piriod selected to reach the annualized return getting in result.

This insight helps users understand that:

- Markets do not actually move this smoothly

- Annualized return simplifies uneven real-world performance

- The rate exists mathematically, not practically

This clarity prevents overconfidence and misinterpretation.

How Professionals Use Annualized Return

Financial professionals use annualized return to:

- Compare mutual funds across different time periods

- Evaluate portfolio efficiency

- Benchmark investments against indices

- Report standardized performance metrics

It is an industry-standard reporting measure, not a trading signal.

Key Takeaways

- Annualized return converts total return into a yearly equivalent

- It is a normalized, mathematical rate—not an actual annual return

- Best suited for investments held longer than one year

- Not recommended for short-term trades

- Useful for fair comparison and long-term evaluation

Final Thoughts

An Annualized Return Calculator is a powerful analytical tool when used correctly. It helps investors understand performance on a standardized scale, compare investments fairly, and evaluate long-term growth efficiency.

However, it should always be interpreted in context. Annualized return explains the past—it does not promise the future.

Used wisely, it brings clarity. Used blindly, it can mislead.

Understanding this difference is what separates informed investors from confused ones.