EMI Calculator

EMI Calculator Loan Amount (₹): Annual Interest Rate (%): Loan Tenure (in years): Calculate EMI Results: Monthly EMI: 0 Total Interest Payable: 0 Total Amount Payable: 0

EMI Calculator Loan Amount (₹): Annual Interest Rate (%): Loan Tenure (in years): Calculate EMI Results: Monthly EMI: 0 Total Interest Payable: 0 Total Amount Payable: 0

In the world of value investing, the Intrinsic value formula will help you to calculate a stock’s intrinsic value which is crucial for making informed investment decisions. One of the most widely used methods for Stock Valuation was Popularized by Benjamin Graham, the father of value investing. His formula for estimating the intrinsic value of…

SIP Calculator Monthly Investment (₹): Annual Rate of Return (%): Tenure (Years): Calculate Results: Total Invested Amount: ₹0 Future Value: ₹0 Return on Investment: ₹0

The Nifty 50 index, representing the top 50 companies in India, is a crucial benchmark for both traders and investors. By understanding the behavior of these stocks and applying the right Nifty 50 trading strategies, traders can make informed decisions for short-term gains, while investors can optimize their portfolios for long-term growth. The key data…

CAGR Calculator CAGR Calculator Starting Value (₹): Ending Value (₹): Number of Years: Calculate CAGR

DCF Fair Value Calculator DCF Fair Value Calculator Free Cash Flow (₹ Crore): Growth Rate (%): Discount Rate (WACC, %): Terminal Growth Rate (%): Outstanding Shares (Crore): Calculate Fair Value

The Price to Book ratio is a powerful tool for evaluating the value of stocks, especially for investors analyzing a company’s fundamental health. In this article, we’ll explore what the P/B ratio is, how it’s calculated, and how it’s used by investors to assess whether a stock is undervalued, fairly valued, or overvalued. What is…

Stock market participants are the entities or individuals involved in buying and selling securities in the stock market. These participants play various roles and have different objectives, which can be classified based on the size of their transactions and their holding period. Now let’s understand the some definitions- 1. Transact The term transact in the…

Introduction Many people’s are confused about how to select stocks for trading and investing and also selecting the right stocks is crucial for achieving financial success in the stock market. The process involves various strategies and considerations that cater to different investor profiles, financial goals, and market conditions. Below is a detailed explanation of the…

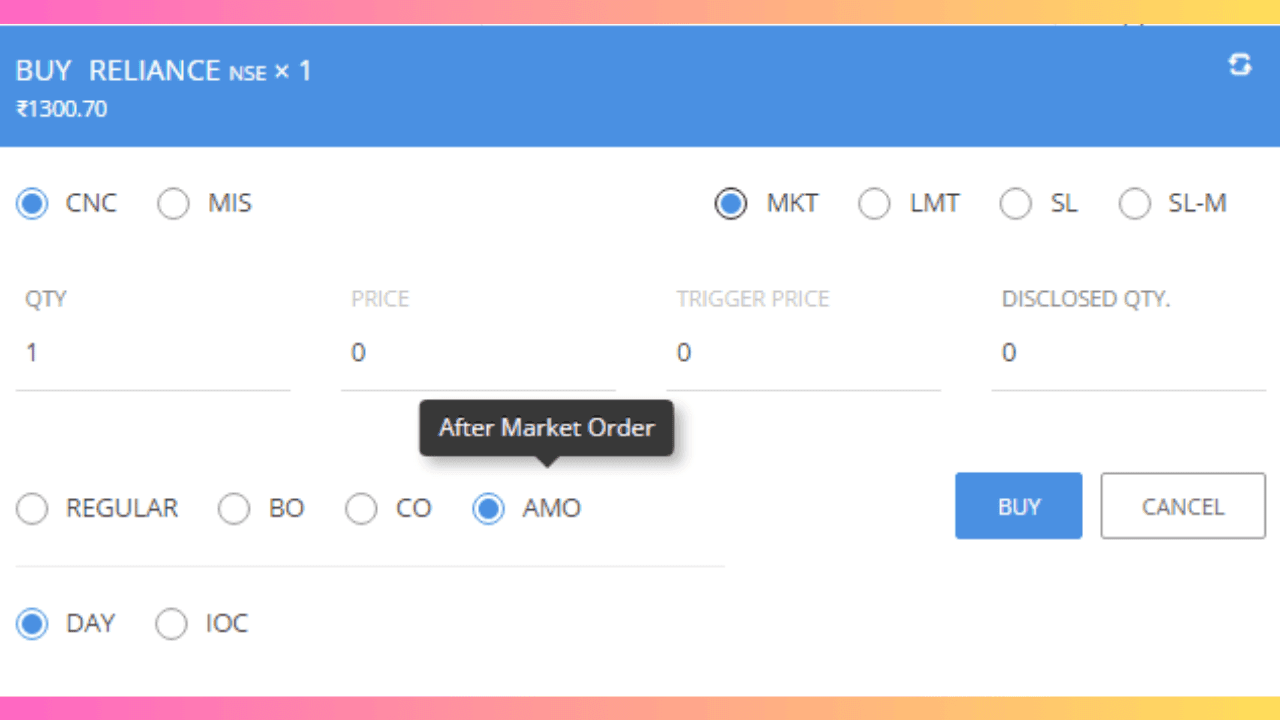

When you begin trading in the stock market, one of the essential skills you’ll need is knowing how to place an order through your broker’s trading terminal. Order facility availability vary broker to broker, so this is very crucial to choose right brokers as per your requirements. The process may seem daunting at first, but…